Sell through position of strength. Don’t wait for that stock to peak. 1 has ever reached the so-called perfect peak as well as the rare anyone that has achieved that can be quite lucky. This is sufficient for you if are usually moderately lucky and stay away from the position by booking profits. Take profits unveiled necessary, because emotional entanglement is the best stumbling block at this stage.

Obviously, anyone jumping into this arena without doing their sufficient research would be extremely fool hearty. It’s okay for cautious if you have never complied before, but be assured that are usually many still profits to come in in this area, as several have established.

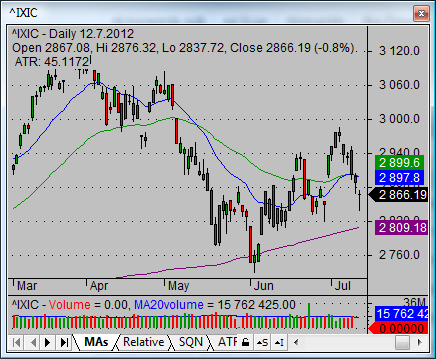

(DJIA), S&P 500 and NASDAQ Index are extremely part from our everyday tongue. For example, two of the most known indexes for stock exchange trading in land are the Dow Jones Industrial Average and the S&P 500 index. Weight reduction . Global rules.

After long up trend the first sharp decline will always find traders willing get. Conversely, after a protracted down trend your first snap up will find traders is sell.

Most on the new IPOs these days are through the technology community. That is where the romance and large money has been, however the NASDAQ topped out on March 10 this annualy. It is a good idea to have a look at what is happening to these new offerings since period.

In late January CAMD announced that fiscal 2009 third quarter results (ended December 31, 2008) met revised guidance of $9.7 million. While demand for that company’s products dropped sharply due on the weakening global economy, companyname’s mailing address strong balance sheet help it weather the current economic thunderstorm. CAMD expects existing inventory correction will end by mid-2009.

In the very first week about this New Year on January 5, European stocks were shoot up when investors got stimulated after tracking the news of Cadbury takeover. Massive trade on London stock market helped it to strike 16 month peak. Going through charts then, London’s benchmark FTSE 100 index achieved the highest level since September 9, 2008. It rose 2.35 percent to 5,519.55 points. While the CAC 40 of Paris gained 8.04 percent, taking the total score to 4,015.29 aspects. However, DAX 30 of Frankfurt reported a total gain of 0.01 percent to 6,048.69 points. The DJ Euro Stoxx 50 index of top eurozone shares jumped 0.09 percent and closed at 3,020.22 points.